Why Fintech Can't Use Software's Playbook

The promise (and danger) of growth in a highly regulated domain

This week, we saw something truly incredible: retail investors coordinating to bid up a few stocks to hurt the hedge funds that shorted them.

At the centre of this episode, we have Robinhood, the investing app of choice for r/WallStreetBets (WSB) users. Robinhood started the week flying high and ended it with a series of lawsuits, a plunge in brand sentiment and a defensive comms campaign from the company's CEO.

A lot has been said about the topic. But I've become fascinated with the product decisions that Robinhood has made to get to this point.

From my view, there are three main product decisions that Robinhood made:

Pursued an activation based growth strategy (over retention and engagement)

Catered the platform to users with lower financial literacy

Encouraged frictionless decision making

This strategy seems reasonable and similar to other growth strategies from tech companies. But having worked as a PM on both growth and consumer fintech products, I learned the hard way that we can’t port over the playbook from traditional software products.

Robinhood shows us that growth strategies from software products don’t work in heavily regulated industries like finance. Their adoption of popular consumer growth tactics led them to create a frictionless product — exposing them to the risks unique to their domain.

Silicon Valley and Blitzscaling

What makes Silicon Valley companies globally competitive? Reid Hoffman, the legendary investor and co-founder of LinkedIn, describes the uniqueness in a single term: blitzscaling — the pursuit of aggressive growth that prioritizes speed over efficiency. This is the ethos that has been behind nearly all of the major Bay Area growth stories: Airbnb, Uber, Facebook and yes, even Robinhood.

Robinhood is a true Silicon Valley company. Founded by two Stanford computer science graduates, the company prides itself on operating as a tech company amongst traditional financial players (think TD Ameritrade and eTrade). Robinhood has an admirable and big mission: democratize finance for all.

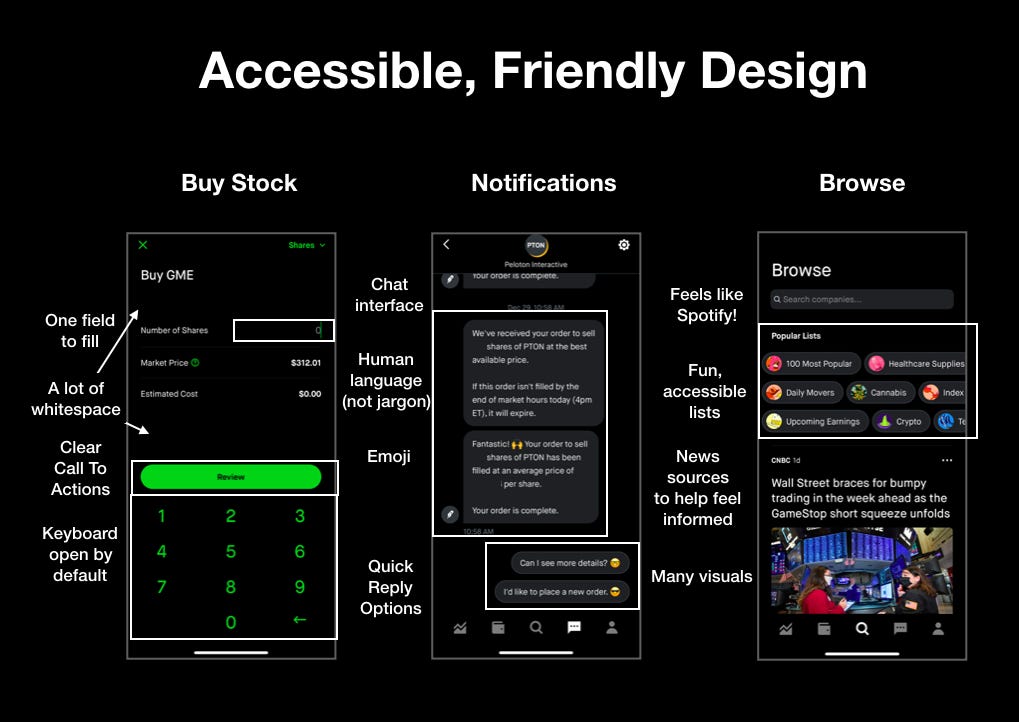

For every tech company, the product is the embodiment of a companies' mission and values. Every design choice, growth strategy and feature gives insight into how the company will achieve its mission. You can learn a lot just from analyzing the design of the product:

We can observe in the product Robinhood’s stated values of being friendly, approachable, and understandable. These values were not chosen at random — they also represent the company's primary way of growing.

The first-principles of product growth

I worked as a growth PM on Facebook Watch, a video tab within the Facebook app. People often think that growth is marketing-driven, but savvy growth teams know that paid acquisition is not sustainable. Instead, the best products look to build growth loops into a product. This helps create organic user acquisition, engagement and retention.

At the base level, product growth is fairly simple:

Identify where users receive value.

In startup circles, this is finding product-market fit. What do users love, and what will make them rave about the product to their friends?

Remove friction to capture that value.

Friction is any step, thought or emotion that stands between a user capturing value. Watch provides value when users find a great video that they want to watch. My job focused on shortening the time it took from navigating to the Watch tab to find a great video to watch. Most of the features in the tab (Subscriptions, Saved Videos, Video Ranking etc.) are designed to remove friction from receiving this value.

In summary, growth is helping users capture value as easily as possible.

Robinhood’s product decisions

Through this lens, Robinhood made a series of product decisions and executed on them for years to achieve growth:

💸 Activation-based growth

Robinhood’s product growth seems to be focused on one question: how can users own their first stock in the least amount of time? In other words, they focused on activating new users as quickly as possible. This is because a key value proposition of Robinhood is that anyone can be an investor. If you can have stock in a few minutes, then they’ve delivered on a core value.

Tactically, they also knew once a user had monetary value in a Robinhood account, they would keep coming back to see if they had made or lost money. Retention and engagement handled themselves.

📚 Cater the platform to users with lower financial literacy

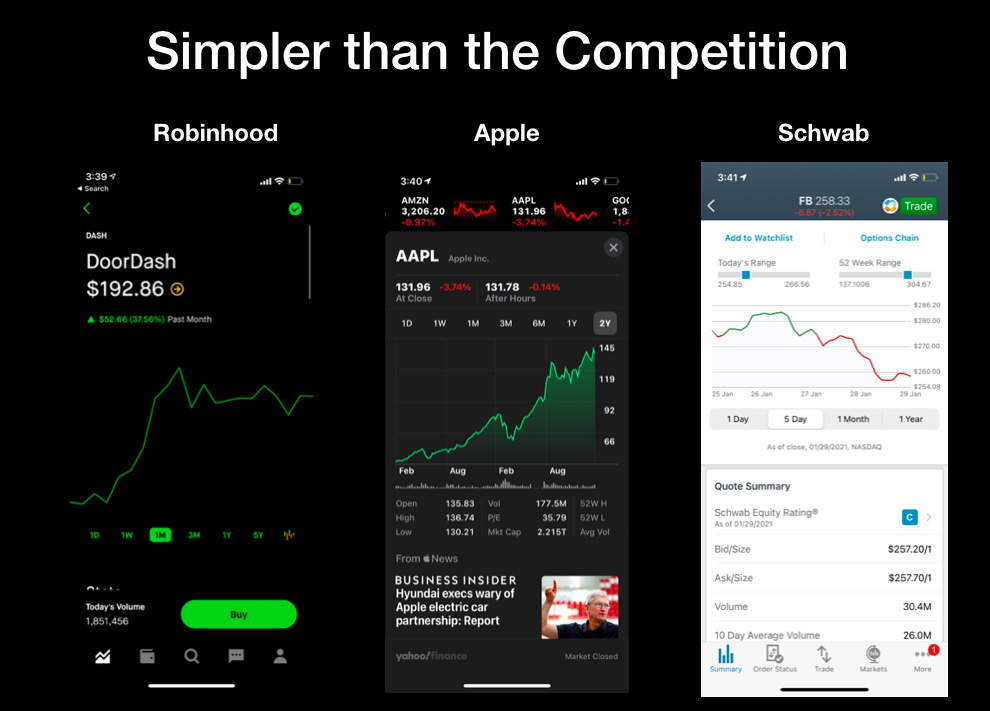

Robinhood values simplicity over power, evidenced in the lack of advanced stock trading tools in the app (ex. analytics tools, insurance). This simplicity provides more value to new, less financial literate users. They’ve continued to cater to these users with an accessible interface and educational modules (ex. Analyst Ratings, Lists and Messages to replace investor reports).

This is why 50% of users say they haven't invested before Robinhood. These may be people who don't know about risks associated with the stock market, how to spot a bubble or what the downsides margin trading might be.

⏩ Encourage frictionless decision making

Robinhood shortens the consideration period of stock purchases to seconds. This is why early marketing focused on commission-free trading. This feature is less about saving users money and more about removing the friction of a commission fee. In this sense, Friction is both the dollar amount and the mental barrier people have when they need to spend money from their pocket.

Today, a purchase of $500,000 can be made in under a minute on Robinhood.

These three product principles are not new. Each of them can be seen in other verticals. TikTok nails activation-based growth by dropping you into a feed within seconds. Webflow caters to low technically literate people who still want to build websites. Wish makes purchasing a $5 shirt so frictionless that you may buy 10 different ones in a sitting.

But something differentiates Robinhood from the other companies who rely on the same growth tactics: the real-world consequences of a decision.

The Tipping Point

By the end of 2020, Robinhood had grown their product to a vibrant community of millennial investors engaged with financial markets. The simplicity of their app blew away the competition, and new investors flocked to it.

Like other tech success stories, Robinhood relied on activation based growth, frictionless decision making and users with lower domain literacy.

This bring us to this week. Robinhood traders pumped up stocks like GME, AMC, NOK, and BB to initiate a short squeeze on hedge funds. The product allows new users (potentially with lower financial literacy) to jump onto the platform to trade these stocks effortlessly. Robinhood is doing exactly what it is meant to do.

But unlike social media, transportation or video streaming, fintech operates in a highly regulated space. A surge of trading is not isolated to the product, which is not true of a surge of bookings on Airbnb, posts on Twitter or riders in a Peloton class. Instead, the trading affects Robinhood's balance sheet, the portfolios of other multinational firms, the SEC and, of course, the finances of millions of individuals.

In other words, unlike other software-specific domains, Robinhood’s product actions are limited by heavily regulated, measurable real-world consequences.

This led to Robinhood curbing trading on all of the WSB stocks. Multiple explanations for the curb have surfaced, but all of them chock up to one reality: Frictionless trading with users with lower financial literacy led to high volumes of speculative purchases, threatening Robinhood’s ability to service them.

The next wave needs a new playbook

The last 20 years of builders cut their teeth on software building search engines, ranking algorithms and online to offline tools. Embedded in the vertical is a culture of experimentation, product-based decisions, and "blitzscaling.” For builders, this is a skillset that has long been seen as the dominant way of creating value on the internet.

But as we enter a new wave, one that promises to tackle more challenging topics like gene editing, space exploration, autonomous vehicles and finance, we cannot port over all the lessons and culture of the past.

This week, we saw what happens when a product uses the growth playbook from software companies in a highly regulated space. In this saga, we see both the promise of new phases of technology and the dangers we'll have to overcome to capture it.

If you’re new to Product Life, subscribe below for concise, actionable and often surprising lessons for product managers.

Until next time,

I really liked the concept of friction and how important it is in building great products and growth strategies companies use. Enjoyed the read Will. Keep at it.

Thanks for providing such an in-depth analysis of the Robinhood app and the eventful market activities that occurred earlier this week!

This might be a stupid question, but how would you conduct a product analysis if you're not a user of the app?

Keep up the amazing content, Will! (: