How I Decided to Dive Into Web3

My step-by-step process for making the jump from Big Tech into this exciting space

Life update: I’ve decided to make the jump from Facebook/Meta into the world of blockchain, crypto and web3. I’ll be joining Paxos as a product manager to modernize financial infrastructure using blockchain. 💸

I consider myself very logical. I don’t tend to act rashly and get a kick out of building frameworks and decision-making structures.

So I want to share my step-by-step process for making this big life decision. I’ll break it down into three repeatable steps:

Choose an area - find a growing area with a problem that you have personal conviction in.

Choose a stage - Decide if you want wartime or peacetime, then zero in on the right maturity for you.

Find a team-fit - find colleagues you respect, a need for your skills, and a strategy you buy

I hope this helps other people who are thinking about their own life transitions. ☺️

1/ Choose an area

Here’s a simple idea: work in a growing area. Venture capitalist Arianna Simpson put this well:

A rising tide lifts all boats. Being in a growing industry or space gives you more room to learn, develop valuable skills and meet other people in similar stages of their careers. I wrote about this idea in more depth here.

The less simple piece is finding the tide you are most bullish on. This requires a combination of objective measures (ex. user growth, top talent mobility) and personal experience.

For me, I’ve been optimistic about payments and financial infrastructure for a long time.

In university, I did my thesis on M-PESA (the largest mobile money network in the world) and its effect on household spending in Kenya.

I was amazed to see how this new financial infrastructure allowed people to send more gross remittances, save more and spend less on transportation (because money was no longer needed to be transacted physically).

I could also see how people could access other financial services other than payments, like loans, mortgages, investments, through this new infrastructure. This was the clearest example I had ever seen of technology giving people better economic opportunity and mobility.

This excitement led me to become a product manager on the WhatsApp Payments team at Facebook. During this time, I led teams focussed on two areas: launching WhatsApp peer-to-peer (P2P) payments in Brazil and scaling our compliance platform to better support anti-money laundering (AML), counter-terrorism financing (CTF), and risk screening.

On the team, I kept bumping into the limitations of payment “rails”. This is the infrastructure (or plumbing) that allows money to move from one account to another. An example of this limitation is how regionally focussed it is -- it's infinitely more challenging for money to move between countries than within countries. This has many consequences, including

the need to customize/re-build payment products in each country

many emerging markets miss out on financial infrastructure

use cases limited by old infrastructure

I shared some of these learnings on Twitter in December 2020 and multiple people suggested that web3 technologies could be a solution.

Blockchains, for example, let digital currencies move instantly on infrastructure not owned by oligopolies and could allow people in Nigeria, Peru, and Japan to all access the same financial products. This got me excited and I started to explore web3.

Looking at my next step, I wanted to solve some of the problems I had encountered trying to build payment products in emerging markets. While many have built on top of existing rails in the past, I was excited by blockchains’ abilities to build new ones altogether.

For that reason, I knew I wanted to dive into the area of new financial infrastructure with blockchain.

The key idea here: I didn't want to choose an area because of hype. Yes, growth is an important factor. But I wanted a rising tide that is in a space I have personal conviction in.

2/ Choose a stage

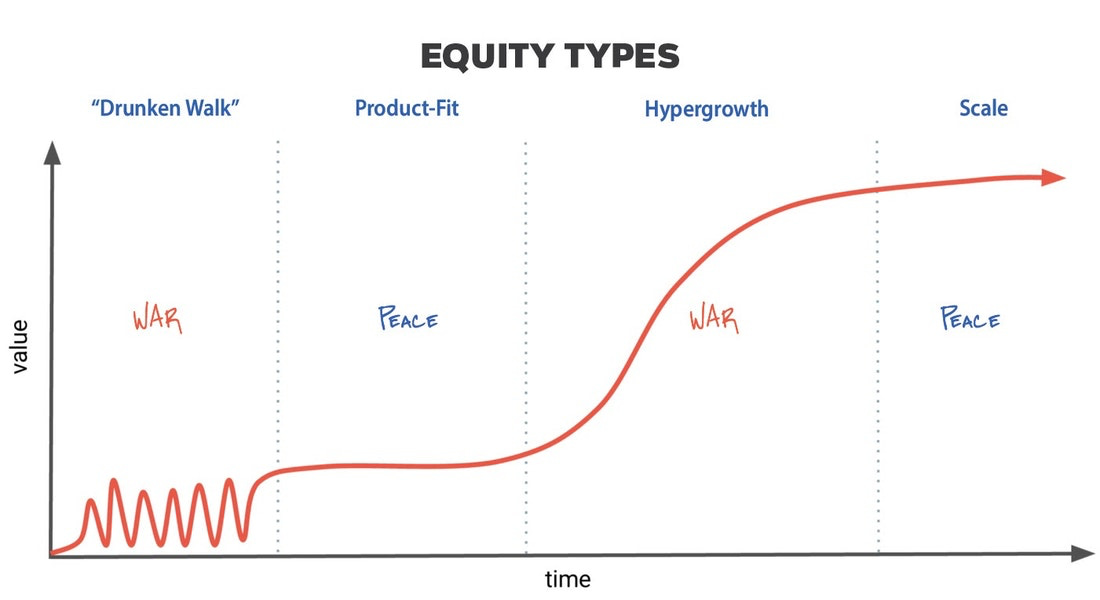

Nikhyl Singh, a VP of product at Meta, wrote a great piece called Stage of company, not name of company. In it, he divides all tech companies into two types: peacetime and wartime.

Big tech is peace. Stable, predictable and "default-alive". There is a lot of benefits to this environment and I learned a ton from my time at Facebook — evidenced by this newsletter’s 40+ articles and 50,000+ words!

But I yearned for war: less structure, more ownership and room to create new ways of doing things.

I’m also at a stage of my life where I’m flexible and can take risks (no kids, no mortgage and some financial runway). It felt like a good time to introduce more risk and accountability.

Nikhyl suggests that there are two "wartime" stages: the drunken walk and hypergrowth. Deciding between the two was interesting and required reflection on my personality and goals.

Although I could see myself becoming a founder one day, I ultimately landed on hypergrowth because it’s where I feel I can add the most value as a PM.

To recap, my framework now had two things completed:

Space: blockchain-based financial infrastructure

Stage: wartime + hypergrowth

It was just down to finding a mutual fit with the right team.

3/ Find team-fit

I looked for a team with:

Colleagues I admire

A strategy I believed in

A need for my skillset

After many great conversations, I knew that Paxos was the right fit for me. The team is incredible, they have great traction and a strong direction for the future.

Paxos is a regulated financial infrastructure company. Many people (even in web3) haven’t heard of Paxos because it operates behind the scenes of some major breakthroughs in crypto. Here are some of the exciting work the team is doing:

Powers the crypto wallets of PayPal, Revolut, MercadoPago, InteractiveBroker and more

Supports USDP and Pax Gold, two regulated stablecoins that unlock new use cases for retail and institutions. Notably, USDP was chosen by Novi (Facebook) to be the stablecoin in the Novi pilot facilitating remittances between Guatemala and the US.

Settlement solutions for institutions like Credit Suisse, Bank of America and Mastercard. This is one of the most exciting areas for enterprise-grade blockchain use cases, allowing for new functionality like T+0 settlement.

The strategy was also clear: build regulated infrastructure that allows assets to move instantaneously, anywhere in the world, at any time.

This strategy, especially the focus on regulation, aligned with my view on how to approach this space based on my time at WhatsApp Payments. I loved that there was a big mission and a deliberate path to get there. I was sold.

P.S. If this mission sounds exciting, Paxos is hiring a ton across many roles:

Software Engineer, Product Managers

Business Development, Sales, Customer Success, Ops

Legal, Compliance, Talent, Accounting

Open roles here. If you have questions, DM me on Twitter.

Ultimately, deciding on the right team is about defining what makes a good team to you. For me, this skewed heavily to the people and was a strategy I could help advance. If you’re still thinking of how to narrow down teams, I’ll suggest another great article by Nikhyl Singh that helped me think about the details of team selection.

Conclusion

I have a lot to learn about blockchain, stablecoins and financial infrastructure and I’m excited to dig in.

I’ll be writing about my lessons from building products in web3 in this newsletter. If this peaks your curiosity (and you’re new here), subscribe below:

If you’re building in web3 or work on financial infrastructure, respond to this email, leave a comment below or DM me on Twitter. I’d love to say hello.

Let’s build! 🧱

Congrats Will - would love for you to speak to the Web3PMs community! Will DM you :)

Amazing, congrats on taking the leap man! Very exciting!